Total & Permanent Disability Insurance - TPD

Partnered with Top Australian retail insurers

If your health stumbles, will your finances crumble?

Secure Finvest can assist you in accessing and navigating the full range of options offered by Australia’s top life insurers.

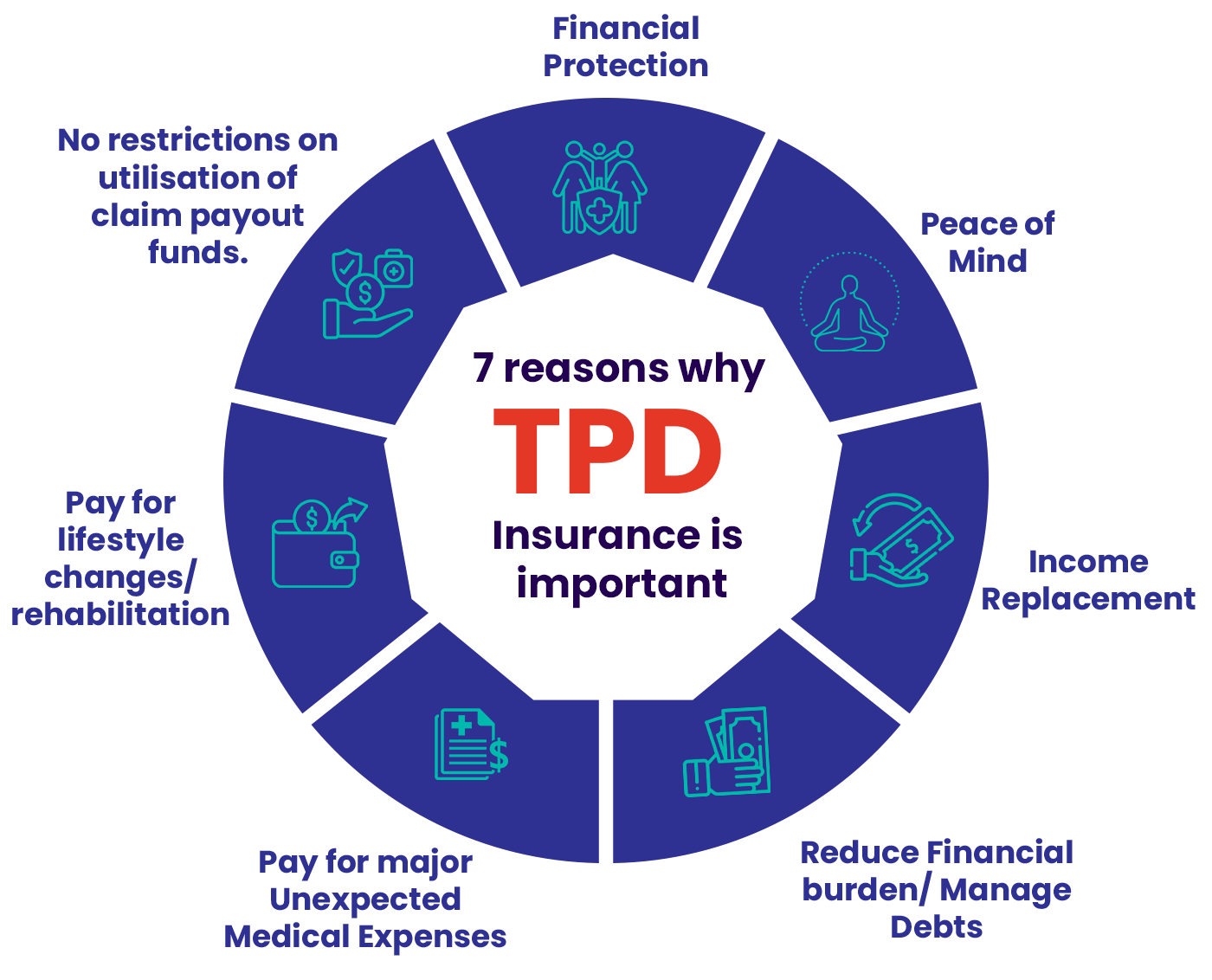

Key Benefits of Life Insurance:

Purpose of Cover

TPD is intended to provide financial support you may need to cover medical expenses, ongoing care, replace lost income due to your disability, pay off significant debts, like your mortgage.

Peace of Mind

Tax treatment

Tailor your cover to suits your needs/ budget

- Stand-Alone Vs Linked Covers

- Any Occupation Vs Own Occupation definition

- Option to pay from your Super/ SMSF or Outside

How much does TPD cover cost?

* The below premiums are indicative and are meant to give you an estimate of approximate premiums.

Quotes are valid as of Feb’2025 & subject to expiry

TPD Cover

Costs are based on:

* Stand-Alone Cover (not attached to life cover)

* TPD defination: Any Occupation

* Non-Smoker

* Health BMI Range

* White Collar Worker

* Standard Rates: Insurers may apply loading/ exclusions based on medical history/pre-existing medical conditions if any.

* Super Rebates will apply if paying through your Super/ SMSF

* Further Discounts/ Tax Deductions may apply based on your scenario OR covers that you take