Life Insurance

Life Insurance (sometimes referred to as Term Insurance or Death Cover) provides a lump sum benefit payment in the event of death or if you are diagnosed with terminal illness.

t’s impossible to know what tomorrow might bring, the key is to be prepared! Life insurance is a long-term investment in your family’s future, it can help ensure that your loved ones are not left with a financial burden.

BE INSURED & ASSURED!

Partnered with Top Australian retail insurers

Life is unpredictable, your insurance shouldn’t be!

Secure Finvest can assist you in accessing and navigating the full range of options offered by Australia’s top life insurers.

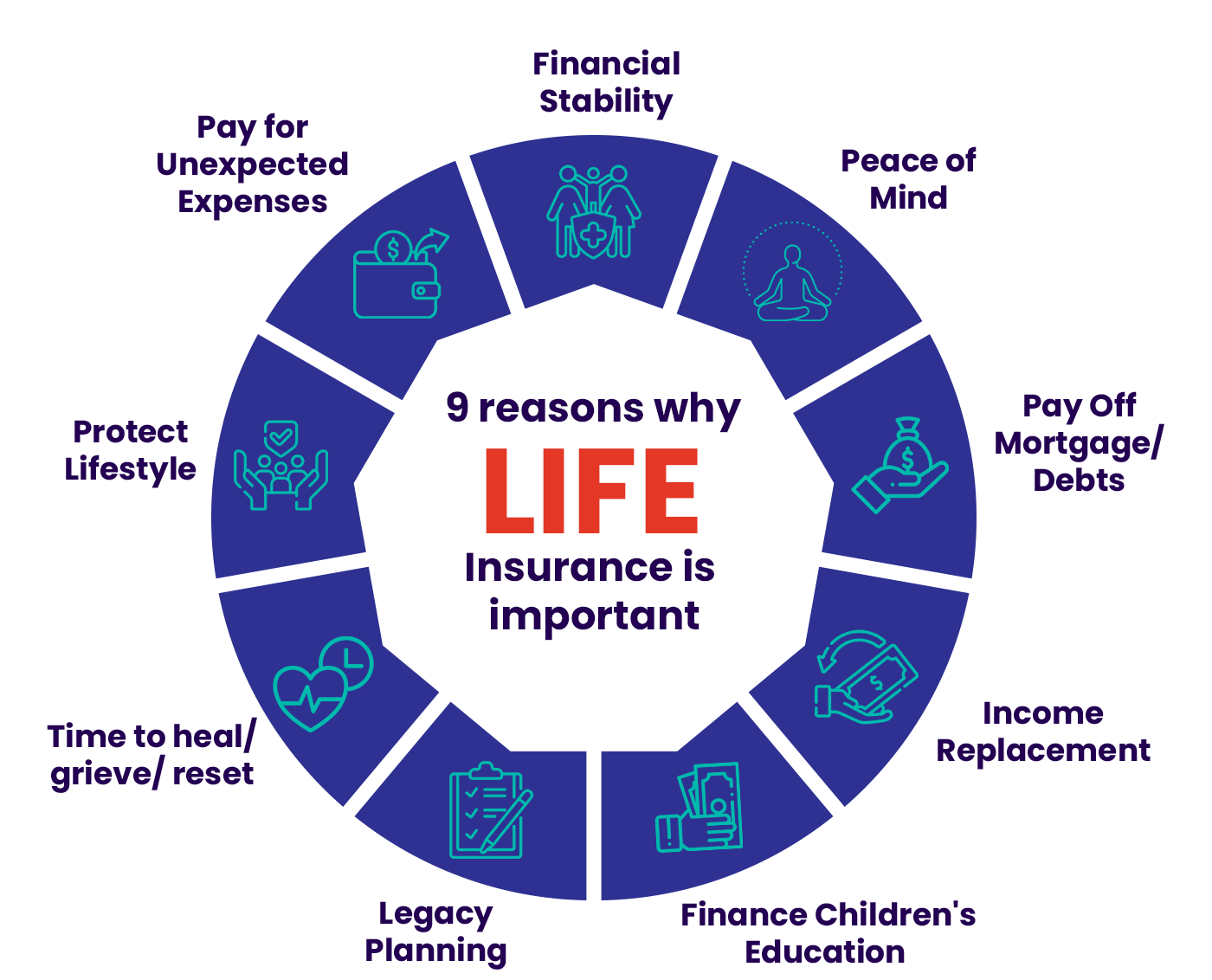

Key Benefits of Life Insurance:

Safeguard your family

Life insurance is more than just a piece of paper; it’s a commitment to safeguard your family when you’re gone.

Cover Major Expenses

Life insurance helps protect your family’s future, covering living expenses, medical bills, funeral costs, mortgage debts, childcare, school/ college expenses.

Peace of mind in times of grief

Life insurance gives your loved ones time to heal/ grieve & reset, ensuring that grieving families don’t have to worry about these expenses during a challenging time. Its helps them continue to living the life you have worked so hard for.

Legacy Planning

Life insurance can be used for legacy planning, leaving a financial inheritance for loved ones, or supporting charitable causes.

How much does Life Insurance cost?

* The below premiums are indicative and are meant to give you an estimate of approximate premiums.

Quotes are valid as of Feb’2025 & subject to expiry

Life Insurance Calculator

Life Insurance Cover

| Male - Monthly Premium | 35 Yrs Old | 40 Yrs Old | 45 Yrs Old | 50 Yrs Old | 55 Yrs Old |

|---|---|---|---|---|---|

| $1 Million Cover | $33 | $38 | $45 | $82 | $162 |

| $1.5 Million Cover | $46 | $53 | $64 | $119 | $237 |

| $2 Million Cover | $58 | $67 | $82 | $154 | $311 |

| Female - Monthly Premium | 35 Yrs Old | 40 Yrs Old | 45 Yrs Old | 50 Yrs Old | 55 Yrs Old |

|---|---|---|---|---|---|

| $1 Million Cover | $26 | $29 | $35 | $63 | $113 |

| $1.5 Million Cover | $36 | $40 | $49 | $91 | $164 |

| $2 Million Cover | $45 | $51 | $62 | $117 | $215 |

Costs are based on:

* Non-Smoker

* Health BMI Range

* White Collar Worker (Occupation: high-risk jobs attract higher premiums due to the increased likelihood of claims)

* Standard Rates: Insurers may apply loading/ exclusions based on medical history/pre-existing medical conditions if any.

* Super Rebates will apply if paying through your Super/ SMSF

* Further Discounts/ Tax Deductions may apply based on your scenario OR covers that you take